Church Events

- Church event fees for employees and their dependents (spouse, children) are waived.

- Up to one helper’s staff retreat expenses are waived if the employee has 2+ children under 13 years old.

- Financially independent children are not counted as dependents (up to college).

Insurance Benefits

All employees receive health, life and travel insurance.

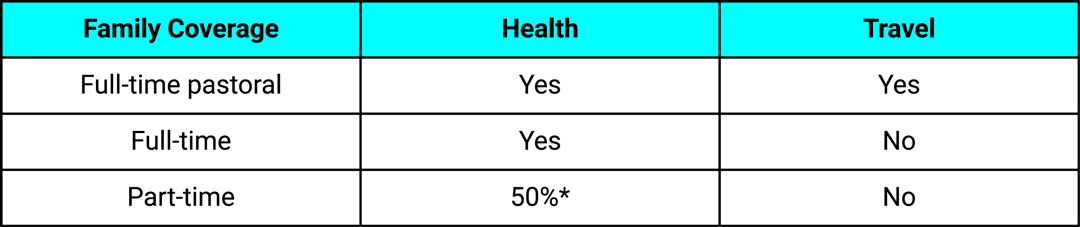

Employee’s Family Coverage

An employee’s spouse and children are eligible for coverage under SP.

* Option to join SP’s group health insurance plan, with SP covering 50% of the premium and the employee paying the rest.

Health Check-up Benefit

Employees who have worked at SP for one year are entitled to a health check-up benefit.

- 50+ can claim up to HKD 4,000 annually.

- Under 50 can claim up to HKD 4,000 biennially.

Unused funds can roll over for up to two terms.

Mandatory Provident Fund (MPF) Scheme

All employees must join the Mandatory Provident Fund Scheme, as required by Hong Kong law. Both SP and the employee will contribute to the fund.

Education/Schooling

Full-time employees may receive school fee subsidies for their children (from kindergarten to secondary education), based on the average ESF school fees, subject to the below:

Full-time Pastoral Employees

Requires prior written approval from the Senior Pastor.

Full-time Non-pastoral Employees

- Employees with at least 2 years of service can apply for school fee grants.

- If they’ve worked part-time for 1 year, the full-time requirement is reduced to 1 year.

- Applications are through the Senior Pastor and Executive Pastor.

- Grants are decided by the Board of Directors on a case-by-case basis, considering employee performance, financial needs, and the church’s finances.

- The Board is not obligated to explain reasons if an application is denied.

Housing

The Senior Pastor’s housing benefits are decided by the Board of Directors.